Cost segregation is a highly beneficial and widely accepted tax planning strategy utilized by commercial real estate owners and tenants to accelerate depreciation deductions, defer tax, and improve cash flow.

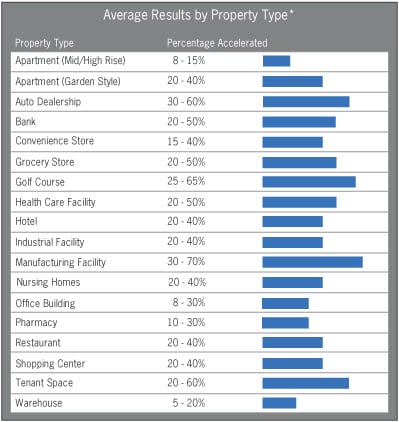

A cost segregation study (CSS) allows taxpayers to accelerate substantial depreciation deductions by identifying costs that can be allocated to shorter recovery periods; primarily 5, 7, and/or 15-year as opposed to 27.5 (residential rental) or 39-year (commercial).

The final Tangible Property Regulations and the Protecting Americans from Tax Hikes (PATH) Act of 2015 have had a tremendous impact on the commercial real estate owner. The recent legislation has expanded the utility of engineering-based tax strategies and created an especially favorable climate in which to perform a study. There has never been a better time to consider cost segregation.

By reallocating these costs to shorter recovery periods, taxpayers can defer substantial tax payments and greatly improve cash flow. Be aware, however, that a cost segregation study does not create new tax deductions; it simply pushes deductions into the early years of ownership. This front-loading of depreciation allows the taxpayer to take advantage of the time value of money. And, as we all know, any amount of money is worth more the sooner it is received.

While property owners and their tax advisors routinely utilize cost segregation following the purchase or completion of a building, there are many additional applications of the practice that apply to the various stages of real estate ownership and development.

A cost segregation study performed on a property placed in service in years past, where a tax return has already been filed, is known as a look-back study. The IRS permits the use of look-back studies to capture the accelerated depreciation the taxpayer was entitled to take, but did not. The catch up, which is taken in a single year, is equal to the difference between what was depreciated and what could have been depreciated if a cost segregation study was performed on day one. The benefit can be quite substantial. Additionally, the change can be made without filing an amended return. The taxpayer simply files Form 3115 (Change in Accounting Method) with the cost segregation study attached.

Any type of commercial property, of any size, placed in service after December 31, 1986 will qualify for a cost segregation study. However, the cost/benefit analysis may prohibit lower valued properties from being good candidates. Typically cost segregation starts to make sense for properties that have a depreciable cost basis of $1 million or more. This value drops to the $300,000 range when considering cost segregation for a leasehold improvement project.

Commercial property owners may want to consider cost segregation if they:

There are a number of benefits associated with cost segregation and its various applications. The primary benefit of course is significantly improved cash flow, most often achieved through the acceleration of depreciation deductions and the resulting tax deferral. In addition to the impact of accelerated depreciation, cost segregation may also allow for the reduction of estimated quarterly tax payments, property tax savings, and transfer tax savings. When prepared correctly, a cost segregation study can also be an excellent asset management tool.

To learn more about using cost segregation throughout the life cycle of real estate and the additional benefits that may be available, please contact Terri S. Johnson at (215) 885-7510 or tjohnson@capstantax.com.

©2024 1031 CORP. All rights reserved. Privacy Policy