Real estate investors often face challenges when it comes to timing, funding, and maximizing the potential of their investments. Whether it is making necessary improvements to replacement properties or securing a new property before selling the old one, complex 1031 exchanges offer creative solutions to achieve both goals while deferring capital gains taxes. This article delves into two advanced strategies: 1031 Improvement Exchanges and Reverse Exchanges, providing actionable insights to enhance your investment success.

Maximizing Value with 1031 Improvement Exchanges

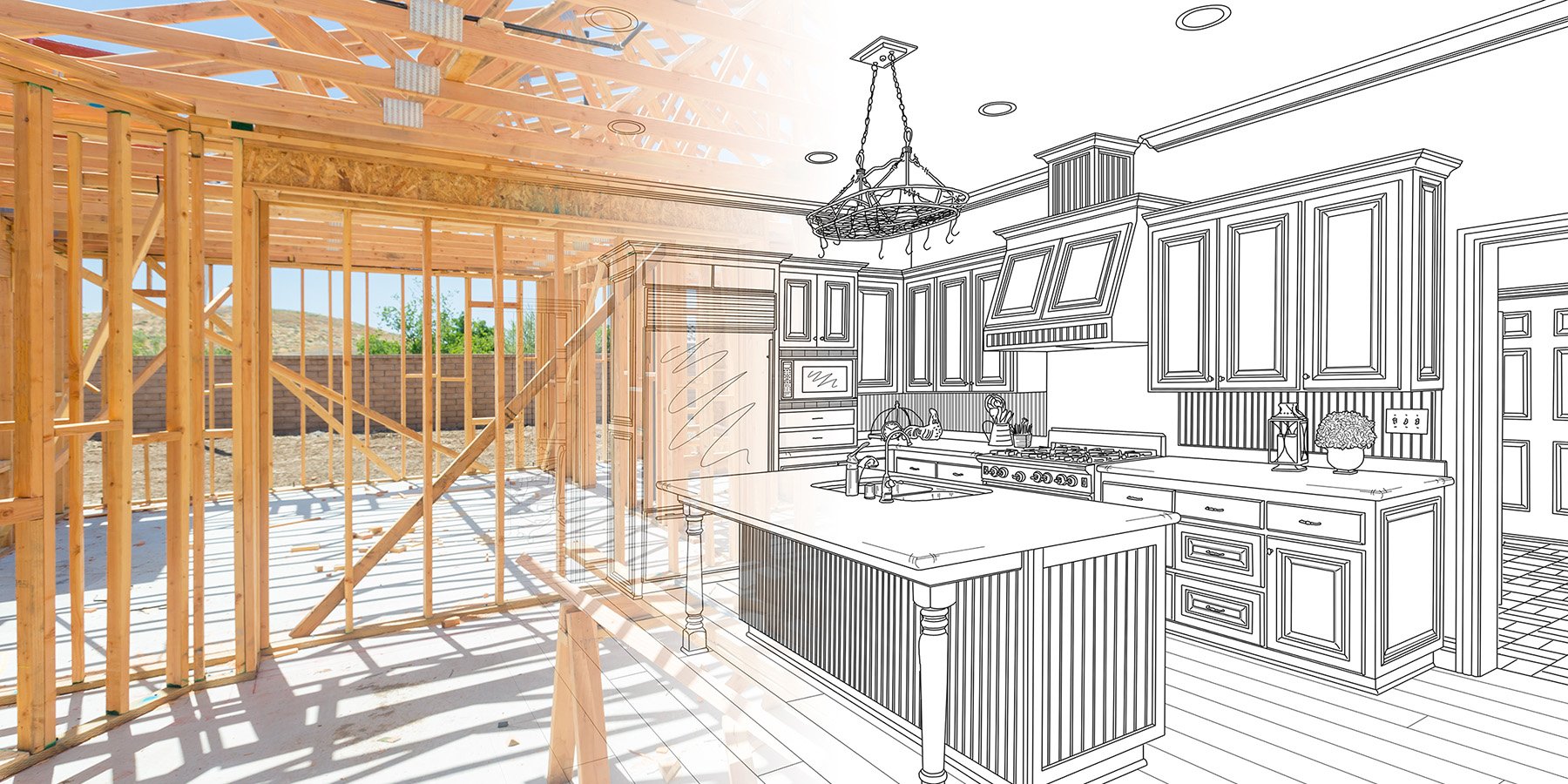

A 1031 Improvement Exchange, also known as a "Build-to-Suit Exchange," enables investors to use exchange proceeds to acquire and improve replacement properties within the 1031 exchange’s 180-Day Exchange Period. This strategy not only allows you to meet your tax deferral requirements but also enhances the value of your replacement property, optimizing its future potential.

How Improvement Exchanges Work

- Sell Relinquished Property: The process begins with selling your property and directing the Qualified Intermediary (QI) to hold the proceeds.

- Acquire and Improve: The QI or an Exchange Accommodation Titleholder (EAT) (aka the Titleholder LLC) acquires the replacement property and oversees improvements using the exchange funds.

- Transfer Ownership: Once the improvements are completed (or the 180-Day Exchange Period expires), the EAT transfers the improved property to you, ensuring compliance with IRS rules.

Forward vs. Reverse Improvement Exchanges

- Forward Improvement Exchange: Sell your relinquished property first. The QI uses the proceeds to acquire and improve the replacement property before transferring it from the EAT to you.

- Reverse Improvement Exchange: Secure your replacement property first, parking it with an EAT while you finalize the sale of your relinquished property. This method is ideal in competitive markets where timing is crucial.

Key Considerations for Success

- Engage Early: Work closely with a Qualified Intermediary and legal advisors to structure your exchange properly. It is also important for your Qualified Intermediary to form your Titleholder LLC/EAT early to ensure timelines are met.

- Strict Timeline: Only improvements completed and paid for within the 180-Day Exchange Period can be added to the purchase price of the property for 1031 exchange purposes. Unused funds or unfinished improvements will reduce your tax benefits.

- Titleholder LLC: Construction contracts and loans must be in the name of the EAT to meet IRS safe harbor requirements. The purchase and sale agreement need not be in the name of the EAT but must be assignable to the EAT.

- Construction Management: You may act as a construction manager, ensuring all work meets the necessary standards and is completed within the required timeframe.

By planning strategically and partnering with experienced professionals, improvement exchanges offer a powerful tool for transforming underutilized properties into high-value investments while deferring capital gains taxes.

Eliminating Uncertainty with Reverse Exchanges

In a competitive real estate market, timing is everything. A Reverse 1031 Exchange allows you to acquire your replacement property first, providing peace of mind and eliminating the pressure of meeting the strict 45-Day Identification window.

How Reverse Exchanges Work

- Parking the Replacement Property: An EAT temporarily holds the title to the replacement property, funded through you and/or a third-party loan.

- Sell the Relinquished Property: You have up to 180 days to sell your relinquished property, ensuring the transaction fits your timeline.

- Final Transfer: Once your relinquished property is sold, the EAT transfers ownership of the replacement property to you, completing the exchange.

Benefits of Reverse Exchanges

- Flexibility: Secure your ideal replacement property without rushing to sell your current property.

- Reduced Risk: Avoid losing out on prime investment opportunities due to timing constraints.

Key Steps to Consider

- Engage a Qualified Intermediary: Work with an experienced QI to navigate the complexities of reverse exchanges.

- Plan Financing: Ensure funds are available to secure the replacement property while awaiting the sale of your relinquished property. Loans must be structured to suit the reverse exchange’s needs, with the EAT acting as the borrower.

- Compliance with Safe Harbor Rules: Adhere to the guidelines set forth in Revenue Procedure 2000-37 to protect the transaction from IRS scrutiny.

Choosing the Right Strategy for Your Needs

Both Improvement Exchanges and Reverse Exchanges provide creative solutions to common challenges faced by real estate investors. Whether you’re looking to enhance your replacement property or lock in a valuable investment, these strategies can help you defer taxes and maximize your returns.

Final Thoughts

- Improvement Exchanges allow you to build value into your investment while meeting 1031 requirements.

- Reverse Exchanges offer the flexibility to secure a property before selling another, eliminating market pressures.

- Both strategies require careful planning, adherence to IRS regulations, and collaboration with experienced professionals. There are also additional transaction expenses with a “parking” exchange.

With the right approach, these advanced 1031 exchange structures can transform the way you manage your real estate portfolio, unlocking new opportunities for growth and success. If you’re considering these options, consult with your Qualified Intermediary, tax advisor, and legal counsel to ensure your transaction is both compliant and profitable.

Want to learn even more? Join us on Tuesday, August 26, 2025, at 12PM ET/9 AM PT for our Mastering Reverse and Improvement 1031 Exchanges presented by Reverse 1031CORP. President, Laura Markham, JD

In this session, you will discover how to successfully navigate complex parking exchange scenarios while meeting your specific real estate investment goals. You'll learn:

- How reverse exchanges allow you to acquire a new property before selling your old one

- When to use improvement exchanges to enhance your replacement property using exchange funds

- How Reverse 1031 CORP. can help you overcome challenges like inventory shortages and timing

Leverage advanced parking strategies to structure a more flexible exchange while still taking advantage of the benefits of a delayed 1031 exchange.