As the seasons change and summer is in the rearview mirror, we long for the warmer weather and our feet in the sand at the beach. It’s also when renters begin searching for the perfect beach rental for next summer. The ability to work remotely has created a greater demand for beach rentals, which has driven up rental rates, making beach properties a desirable investment.

A 1031 exchange is a century-old tax strategy to defer gain when selling business use or investment property and reinvesting in another. In addition to deferring the state and federal gain, investors can also defer the recapture of the depreciation taken on the property and possibly eliminate the 3.8% Net Investment Income Tax on their unearned income. A 1031 exchange, also known as a like-kind exchange, enables sellers to preserve their equity and use it to buy their next investment property. An exchange is just like the sale of one business use or investment property followed by the purchase of another, linked together by the required documentation and completed within 180 days.

Real estate investor Frank, a single man with an annual salary of $225,000 and $125,000 of additional unearned income (rental income, interest, and dividends), has long had a goal of buying a rental property at the Jersey Shore. He has owned a single-family rental in the Philly suburbs for nearly twenty years. The original purchase price was $350,000, and no capital improvements have been made. Frank has taken $150,000 of depreciation.

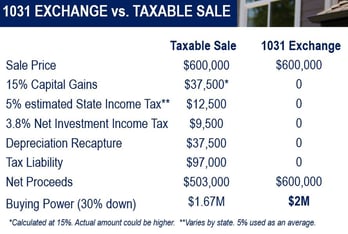

If his property sells for $600,000, he would have a capital gain of $250,000. The estimated state and federal tax would be approximately $97,000. If Frank sells using a 1031 exchange, he could defer the $250,000 gain and the 25% recapture on the $150,000 of depreciation he has taken over the last 20 years. The diagram shows the tax consequences of a taxable sale and a 1031 exchange.

If his property sells for $600,000, he would have a capital gain of $250,000. The estimated state and federal tax would be approximately $97,000. If Frank sells using a 1031 exchange, he could defer the $250,000 gain and the 25% recapture on the $150,000 of depreciation he has taken over the last 20 years. The diagram shows the tax consequences of a taxable sale and a 1031 exchange.

Using a 1031 exchange, Frank could use the $503,000 net proceeds as a 30% deposit on a $2,000,000 Shore property. Leveraging the $97,000 that would have been lost without a 1031 exchange can help Frank buy a replacement property for $330,000 more than he could if he paid the tax. This new, higher-priced replacement property would generate higher annual rental income, make more depreciation available annually, and likely have more long-term appreciation for Frank.

Now, let’s think about the current owners of the Shore property Frank wants to buy. Gene and Helen have owned the property for more than 30 years. Between the original purchase price and the improvements made, they have a $600,000 basis. With a possible sale price of $2,000,000, they worry about the taxes on a $1,400,000 gain and almost $350,000 of depreciation to recapture. They have considered a 1031 exchange, but now in their 70s, they don’t want to buy another investment property.

Lucky for them, Gene and Helen learned about Delaware Statutory Trusts (DSTs), an alternative 1031 replacement property that allows them to acquire fractional ownership in commercial real estate. A DST is a grantor trust enabling accredited investors to acquire a beneficial interest with limited liability, steady cash flow, and no management responsibilities. A few examples of a DST are a large industrial complex along Interstate 80, ten drug stores across the Mid-West, and several multi-family developments in the Southwest. This alternative solution makes a 1031 exchange more appealing to Gene and Helen and motivates them to list their property.

The tax deferral is why most investors initiate a 1031 exchange. However, the most powerful benefits of an exchange are the preservation of your equity and the time value of the deferral. The deferred gains ensure all of your other income is taxed at a lower rate, and you have the opportunity to grow your real estate portfolio with pre-tax dollars. Additionally, under current estate tax law, when you pass away, your heirs inherit the property with a step-up basis, and all gain is forgiven. Your heirs will inherit the property at the fair market value at the time of death, and assuming your estate is valued at less than $12.92M, there may be no federal tax due.

There are a few things to keep in mind when contemplating a 1031 exchange:

- A qualified intermediary (QI) must be used to facilitate your 1031 exchange.

- Your exchange must be initiated with the QI before closing on the relinquished property.

- Any real property can be “mixed and matched” provided the relinquished and replacement properties are held for use in a trade or business or for investment.

- From the date the relinquished property is transferred to a buyer, you have 45 days to identify replacement property. Running concurrently, you have 180 days to acquire your replacement property.

- To maximize your tax deferral, you must acquire replacement property equal to or greater in value and equity than your relinquished property. A trade-down in value or equity is taxable and referred to as boot.

- The replacement property must be owned by the same owner/taxpayer who owned the old property and reported it on their tax return.

- You cannot have actual or constructive rights to the exchange proceeds from the relinquished property sale during the exchange period. The funds will be deposited into an exchange account and controlled by the QI during the exchange period.

- Your QI cannot provide tax or legal advice. You should always discuss your transaction with a tax or legal advisor.

A 1031 exchange is a strategy to build and preserve wealth. The more you know about 1031 exchanges, the more you can use them to accomplish your short and long-term real estate investment goals.

If you would like to schedule a complimentary consultation to discuss your transaction with one of our 1031 CORP. Exchange Team members, please click here.